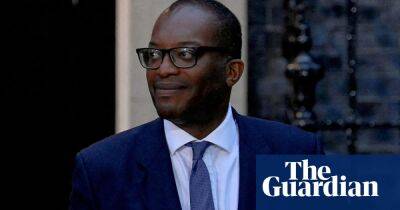

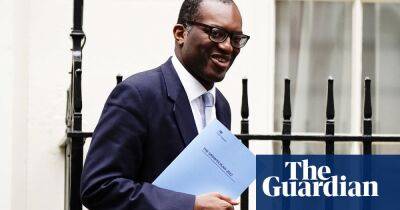

History would suggest Kwarteng’s hefty tax giveaway is a huge gamble

A struggling economy. An unpopular Conservative government. A dramatic change of course. Britain has been here before. Just like Reginald Maudling in the early 1960s and Tony Barber in the early 1970s, Kwasi Kwarteng has gone for broke, with a massive package of tax cuts designed to put Britain on a higher growth path.

The chancellor will be crossing his fingers that his experiment has a happier ending than those of his predecessors, neither of which ended well. It is one huge gamble on supply-side reforms boosting enterprise, tax cuts paying for themselves, and the financial markets remaining onside. The initial reaction from the City was not entirely reassuring.

No question, this was a big package, a full-scale budget in all but name. Kwarteng delivered on all the tax pledges made by Liz Truss during her leadership bid – and more. The 45% rate of income tax for the highest earners has been scrapped; a reduction in the basic rate from 20% to 19% pencilled in by the previous chancellor, Rishi Sunak, for 2024 has been brought forward by a year.

Put together with the removal of the increase in national insurance contributions and the decision not to go ahead with next April’s increase in corporation tax and you get a £45bn giveaway, not quite as big as Barber in 1972 but hefty by historical standards.

Kwarteng’s insistence that the government was committed to fiscal responsibility was greeted with derision from Labour MPs, particularly given the lack of independent scrutiny of the chancellor’s arithmetic from the Office for Budget Responsibility. Such an exercise might have questioned the new-found belief in the Treasury that new investment zones, slashing red tape, tougher welfare rules and an end to the bankers’ bonus cap

Read more on theguardian.com