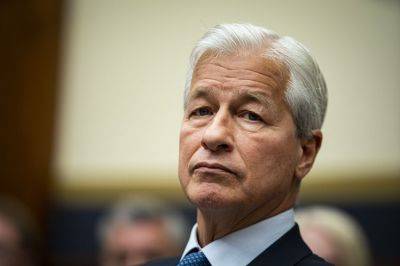

Jamie Dimon warns souring commercial real estate loans could threaten some banks

Deposit runs have led to the collapse of three U.S. banks this year, but another concern is building on the horizon.

Commercial real estate is the area most likely to cause problems for lenders, JPMorgan Chase CEO Jamie Dimon told analysts Monday.

«There's always an off-sides,» Dimon said in a question-and-answer session during his bank's investor conference. «The off-sides in this case will probably be real estate. It'll be certain locations, certain office properties, certain construction loans. It could be very isolated; it won't be every bank.»

U.S. banks have experienced historically low loan defaults over the last few years due to low interest rates and the flood of stimulus money unleashed during the Covid-19 pandemic. But the Federal Reserve has hiked rates to fight inflation, which has changed the landscape. Commercial buildings in some markets, including tech-centric San Francisco, may take a hit as remote workers are reluctant to return to offices.

«There will be a credit cycle. My view is it will be very normal» with the exception of real estate, Dimon said.

For example, if unemployment rises sharply, credit card losses might surge to 6% or 7%, Dimon said. But that will still be lower than the 10% experienced during the 2008 crisis, he added.

Separately, Dimon said banks — especially the smaller ones most affected by the industry's recent turmoil — need to plan for interest rates to rise far higher than most expect.

«I think everyone should be prepared for rates going higher from here,» up to 6% or 7%,Dimon said.

The Fed concluded last month mismanagement of interest-rate risks contributed to the failure of Silicon Valley Bank earlier this year.

The industry is already building capital for potential losses

Read more on cnbc.com

cnbc.com

cnbc.com